Webinar, 29 September 2020 - Beneficial ownership is a crucial element in the fight against corruption. It enables the proceeds of crime to be linked to legal persons, and allows us to know who is behind companies and investment vehicles.

Research suggests that corporate vehicles – such as companies, trusts, foundations and fictional entities – are routinely used to hide the identities of those behind corruption with impunity, and to conceal the proceeds of crime. Such techniques have a significant impact on the region, incurring over $80 billion USD of illicit outflows over 2006-2015 (Global Financial Integrity 2019). The proceeds of organised crime in Southeast Asia are thought to total $73.4 - $110.4 billion USD annually (UNODC 2019).

To promote the transparency of beneficial ownership, UNODC has been holding a series of workshops and online trainings with experts and practitioners across Southeast Asia. On 29 September, UNODC held a bespoke webinar on this issue, looking at challenges and steps forward for the region. The online event was attended virtually by some 170 participants, the majority of whom represented national agencies across Southeast Asia.

These are the main messages highlighted by speakers and participants:

Beneficial Ownership is a Game Changer in the Fight Against Corruption

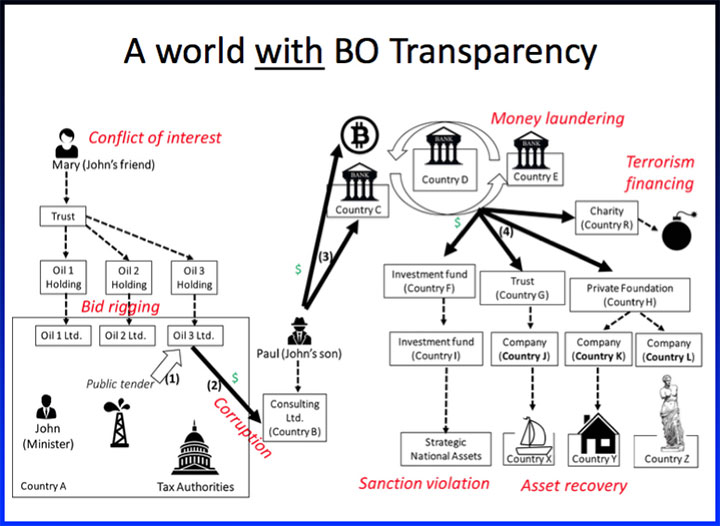

“Without transparency, it is difficult to ascertain whether corruption measures are sufficient” explained Andres Knobel, researcher at the Tax Justice Network, “or whether corruption and money laundering in fact festers beneath the surface.” For example, services may be put out to a public tender effectively, but without transparent legal ownership, it would not be clear whether the various companies participating in the tender are in fact owned by the same individuals. The anonymity afforded by the use of corporate vehicles can clear the way for crimes including bid rigging, conflicts of interest, tax evasion, money laundering and terrorist financing.

Andres Knobel Outlines Advantages of Beneficial Ownership

While the importance of transparency of beneficial ownership is becoming more widely understood, its realisation can be complex. In many countries, elements of beneficial ownership areimplicit in the existing information that companies provide, e.g. through correspondence with banks, notaries, lawyers and tax administrations. However, because of the sheer volume of information, verification is more effective in the hands of a central register – an approach that roughly 85 jurisdictions have now moved to embrace.

Technology & Open Data Are Essential

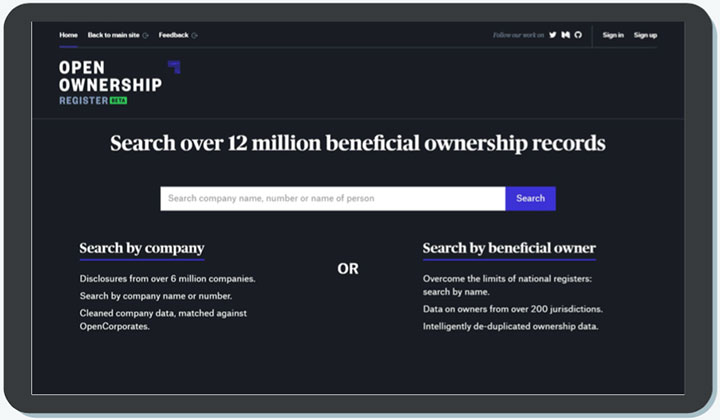

Even with a central register, it is difficult to ensure that information is verified and up-to-date. According to Steve Day, technical lead at Open Ownership, countries should aspire to meet Beneficial Ownership Data Standards (BODS), to enable mutually intelligible information to be shared and collated across borders. Through newly sophisticated levels of technology, claims about beneficial ownership can be visualised across a timeline of historic snapshots, applying red flags automatically without the need for the manual collation of asset disclosures. With standardised, open data, datasets from different countries can be merged, revealing a broader and interlinked scope of ownership networks.

Mr Day demonstrates value of searchable, international registers through the Open Ownership Register

Indeed, the full extent of beneficial ownership is something which no State can capture alone. Ideally, registries receiving information would systematically verify and share information with a host of practitioners, including Financial Intelligence Units (FIUs), banks and registries abroad.

Mr Knobel drew on the example of Denmark, which carries out automated cross-checks, applies machine learning technology and contacts the beneficial owner to verify that they are real and aware of their ‘beneficial ownership’ status. Meanwhile, in Uruguay, non-compliant entities can have their tax identification suspended, meaning that they would not be able to operate without cooperating with the special unit in charge of manual verification.

[A framework developed by Open Ownership on best practices for beneficial ownership disclosures can be viewed here] What does this mean for contexts in which resources are limited? “In instances where the rollout of technology might be a challenge, Open Ownership has advised countries to create paper-based forms, to collect information that can then be digitised”, Mr Day explained. “But to reduce the risk of errors, it would be better for systems to be digitised from the point of use”.

What does this mean for contexts in which resources are limited? “In instances where the rollout of technology might be a challenge, Open Ownership has advised countries to create paper-based forms, to collect information that can then be digitised”, Mr Day explained. “But to reduce the risk of errors, it would be better for systems to be digitised from the point of use”.

At the same time, a technology-based approach is not the only way to improve the accuracy of beneficial ownership data. As Cornelia Koertl (UNODC Associate Crime Prevention and Criminal Justice Officer) argued, registers need to be willing to invoke sanctions to incentivise compliance, to ensure that information is updated on time. Far from verification being the sole obligation of registries, she called for greater domestic and international cooperation, along with civil society participation, to help provide oversight. Ideally, registries should be searchable and show historic changes, so that collaboration can happen effectively.

Identifying Beneficial Owners in Southeast Asia

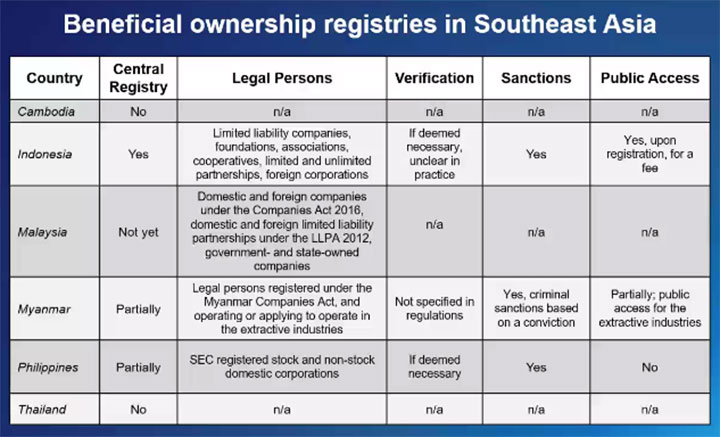

Encouragingly, progress on beneficial ownership is being made in Southeast Asia. As a recent UNODC study shows, the majority of countries in the region now have a broadly clear definition of beneficial ownership. A central registry has been established in Indonesia, with registries in the process of being developed in some form in Malaysia, Myanmar and the Philippines. Meanwhile, registers have yet to be developed in the other countries in the region.

UNODC study on beneficial ownership shows progress made across Southeast Asia

Even where central registries have been established, the sharing of data can be challenging. Mr Cahyo Muzhar, Director General of Legal Administrative Affairs at the Ministry of Law and Human Rights of Indonesia, suggested that countries have to prioritise legal entities to focus on, based on an assessment of risks – including those related to money laundering and terrorist financing. In the case of Indonesia, he singled out limited liability companies and companies involved in mining and plantations, as entities with sizeable assets that are typically involved in a high volume of transactions. To improve data sharing, Indonesia is now working to integrate company databases with the central registry, and to improve its online submission system.

Looking to the region as a whole, the UNODC study found that the threshold above which beneficial ownership information is required to vary significantly. “Ideally, of course, there would be no threshold at all”, Mr Knobel argued. While some might perceive this as costly for businesses, he gave the example of minor shareholders, which tend to be acknowledged within internal company information regardless of how little shares they own. He also warned that having a percentage of ownership as a threshold runs the risk or rewarding secrecy and complexity, whereas in fact registries should be seeking to reduce the complexity of ownership chains – an approach being looked into by the Tax Justice Network.

Regionally, another key challenge involves the verification of beneficial ownership information. Although sanctions can be applied in Indonesia, the Philippines and Myanmar in principle, the mechanism through which verification actually takes place is unclear in many countries. “Overall, countries are not publishing enough statistics on the application of sanctions,” argued Mr Knobel, referring to the situation globally. “At a minimum, the Global Forum advises that registries are able to remove companies that do not comply with providing information.”

Other Links